Imagine this: you’re sipping coffee at your kitchen table while browsing job listings or preparing to make a major financial decision like buying a home, investing, or budgeting better. In all your calculations, your annual income keeps cropping up as an issue; but how exactly should it be calculated accurately?

No matter if you are salaried employee, hourly worker, freelancer or even juggling multiple gigs – knowing your annual income is absolutely critical to budgeting, tax planning, loan approvals and even negotiating higher salaries. Let’s break it down in an engaging, straightforward way!

What Is Annual Income?

Simply stated, annual income refers to the total sum you make in one year before taxes and deductions have been applied. This income could come from various sources such as:

Your annual income can be divided into two broad categories:

Salaries/hourly wages/bonuses commissions and freelancing work or side gigs as well as bonuses and commissions and rental income or dividends and investments

Gross Annual Income – Your earnings before taxes, insurance and retirement contributions have been deducted;

Net Annual Income – what actually arrives in your bank account after all those deductions.

How to Calculate Annual Income Based on Job Type

1. Salaried Employees: For Easy Calculations.

Assuming you work a salaried job, calculating your annual income should be straightforward – simply subtract out your annual salary as stated in your employment contract.

Examples:

If your annual gross income is $60,000, just divide by 12 and find your monthly income:

What If You Receive Bonuses or Commissions

If your company granted you a $5,000 bonus last year, add that amount to your annual income for an adjusted total. In other words:

2. Hourly Workers:

Calculations Is Easy Hourly workers need to do some quick calculations when receiving pay by the hour. If this is your situation, take the following steps.

Formula:

Wage per Hour multiplied by Total Hours Worked per Week multiplied by Total Weeks Worked Per Year = Annual Income

Consider that you earn $20 an hour, work 40 hours a week and 50 weeks per year (assuming two weeks off for vacation).

20 x 40 x 50 = $40,000 per year.

Whenever you work overtime and earn time-and-a-half (1.5x your normal rate), don’t forget to include those earnings!

3. Freelancers and Gig Workers: Variable Income Calculations

Freelancers, independent contractors and gig workers often have unpredictability in their income sources which makes calculating annual earnings more complex.

Here’s a proven approach:

[The following should help: [ Example of what could happen:

Subtract $4,000, $5,500 and $3,200 respectively from January through June for total costs. In April alone you would pay $4,700 in May and $5,300 in June. Our total annual expenditure would total $57,399.96

Due to freelance income being unpredictable, it’s wise to make conservative estimates in order to budget appropriately.

4. Multiple Jobs? No Issue

Calculating Your Annual Income

When you work multiple jobs, calculating your total annual income involves totalling everything together.

Example: of annual income for this scenario is as follows: For a full-time job: $50,000 annually and part-time weekend work at $15 an hour over 15 hours each week over 50 weeks = $11,250, along with freelancing income of $5,000 = Total Annual Income is: $50K + 11250 + $500 = $66,250 annually.

Why Does Understanding Your Annual Income Matter?

1) Budgeting and Saving Smarter

Are you tired of running out of money before the month is through? Perhaps your budgeting method is incorrectly accounting for actual figures rather than making assumptions based on rough guesses about annual income. Knowing your annual income accurately allows you to manage monthly expenses more accurately.

2. Taxes & Deductions

Once tax season arrives, your gross income determines how much tax is due (or returned back). Any miscalculation could mean underpaying taxes which would result in penalties being assessed to you – making sure to do your math before filing could save time and headaches later on!

3. Loan Approvals and Creditworthiness

Looking to purchase a house or car soon? Lenders rely on your annual income as part of their criteria when considering loan approvals; their debt-to-income (DTI) ratio plays a vital role.

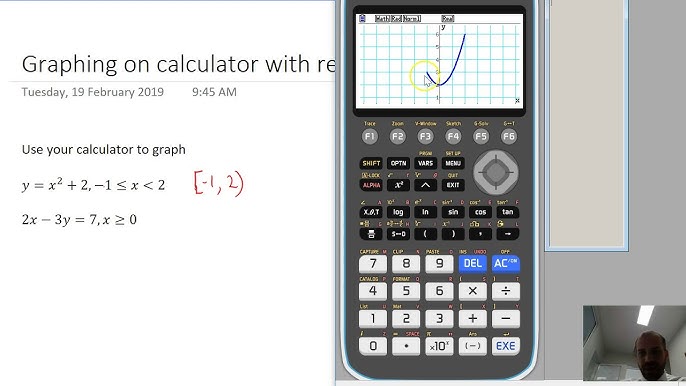

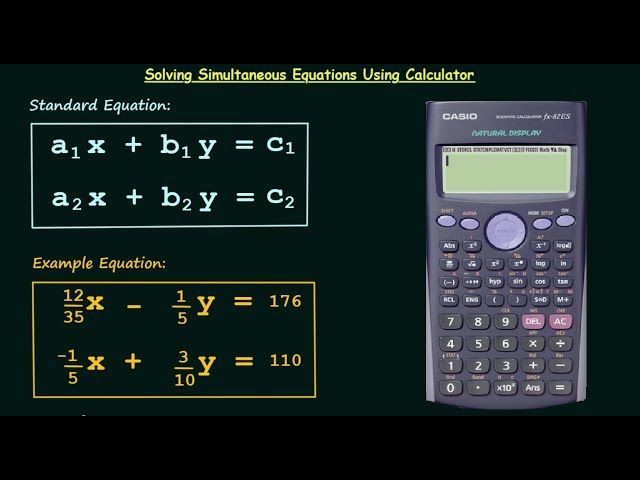

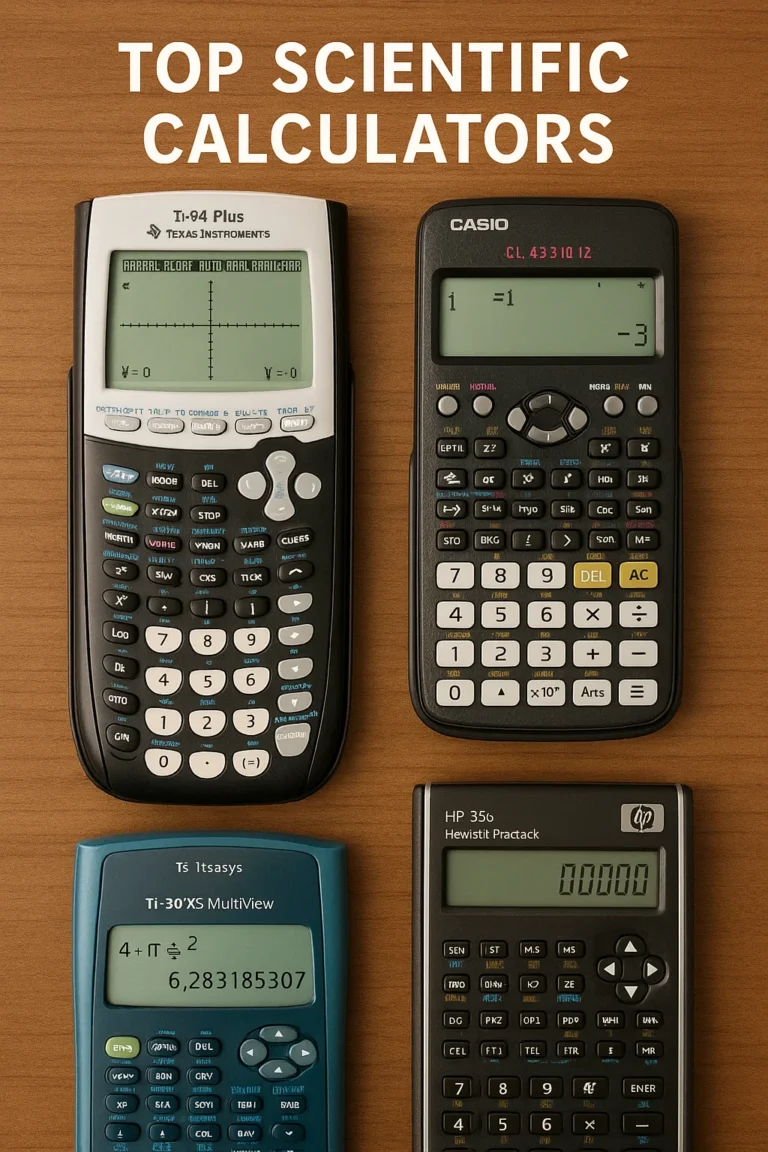

An Online Calculator Can Make Life Easier

Instead of crunching numbers manually, an online scientific calculator can make life much simpler. These handy tools can assist with hourly to salary conversions, tax deductions and even side gig earnings calculations.

Just enter your pay information, and the online calculator scientific tools will do the rest – providing a quick and accurate breakdown.

Final Thoughts: Make Your Money Work for You

Being aware of how much your annual income isn’t just about numbers – it’s about power. Knowing exactly how much is coming in allows you to manage it more effectively by budgeting better, saving smarter, and planning for a more secure financial future.

So the next time someone asks “How much do you make?,” you won’t just guess–you’ll know for certain!

Take a close look at your numbers – you might just discover that you are making more (or less!) than expected!