Imagine this: After an exciting month at your small business, and an eagerness to check your bank balance. Sales were up, customers satisfied and revenue skyrocketed – yet when looking at the final numbers it doesn’t feel quite as impressive as anticipated – where has all this money gone?

If this sounds familiar to you, you aren’t alone. Many business owners, freelancers and salaried professionals struggle with understanding net income – the amount left over after expenses. Learning how to calculate net income can give you greater control of your financial future and give you greater financial autonomy.

No matter if you are running a business or managing personal finances, this guide provides everything you need to know about net income in an engaging, straightforward way. No jargon here: just real-life insights designed to help you take control of your money!

What Is Net Income and Why Does It Matter?

Your net income refers to any leftover earnings after expenses have been deducted from total earnings. Think of it as your real earnings–what can actually be spent or reinvested.

Why Should You Care About Net Income?

For Business Owners: Net income measures how profitable your company is. Having high revenue alone doesn’t guarantee anything; expenses could eat into all that profit quickly enough to leave no surplus for further development of the business.

As a freelancer: understanding your net income will allow you to set the appropriate rates and save enough for taxes.

Employees: Knowing your net income helps with budgeting, saving and making sound financial decisions.

Simply stated, failing to track your net income could cause you to overestimate how much cash is actually in your possession.

Net Income vs Revenue: Why They’re NOT the Same (INFOGRAPHIC)

Some businesspeople confuse revenue for net income. Here’s one way of looking at it:

Revenue refers to all the money you bring in.

Net Income measures what remains after expenses, taxes and other costs have been deducted.

Real-Life Example:

Within this scenario, let us assume you operate an online bakery.

- Assume you sell $10,000 worth of cakes every month (your revenue).

- When expenses are deducted, ingredients, rent, and delivery cost $3,000 while staff salaries.

- Totaling $2,000 plus taxes totalling $500 are also paid for in full by you – your net profit after all expenses is $4,500 instead.

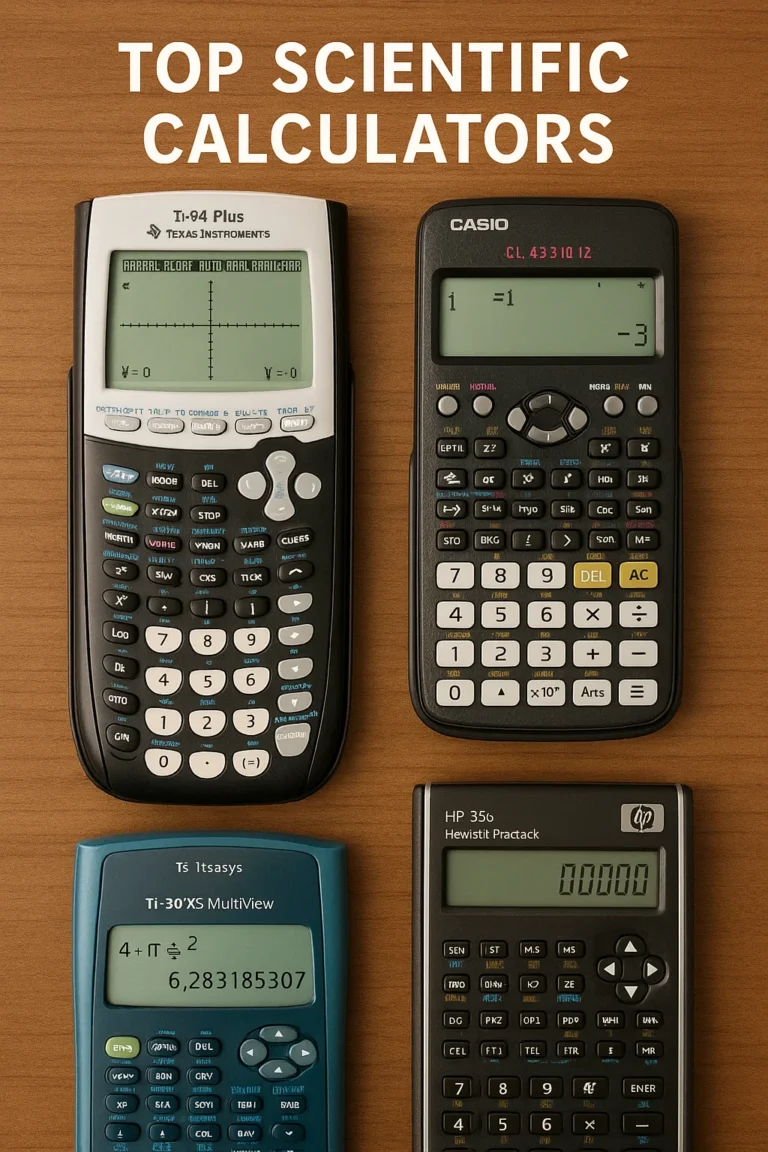

People using an online scientific calculator to quickly and accurately estimate earnings often use this handy tool. From business expenses and deductions to personal budgeting needs, using an online calculator scientific makes staying on top of finances much simpler than ever.

Where Does Your Money Go? Breaking Down Expenses

Before calculating net income, it’s essential to have an idea of where your money goes. Here are the expenses which most frequently influence it:

1. Operating Costs

Operating costs refers to expenses necessary for running and maintaining a business or job.

Owners: rent, supplies, salaries, marketing costs and website hosting fees; for freelancers these include software subscriptions, internet bills and workspace costs; while employees incur costs related to transportation costs, work attire and meals during office hours.

2. Taxes

Without question, taxes play an integral part in determining your final income. From business taxes and self-employment tax deductions to personal income tax payments and personal estate tax – taxes have the ability to significantly impact how much net earnings remain available for use.

3. Loan Payments and Debt

Wage Dependence If you took out a business loan, student loan, or have credit card debt payments can have an effect on how much money is actually in your wallet.

4. Miscellaneous Costs

Unanticipated expenses like repairs, new equipment purchases or emergency costs can drastically eat into your income if you’re unprepared.

How to Gain Control Over Your Net Income

Once we understand what net income is and where your money goes, let’s discuss ways of increasing financial clarity.

1. Track Each Dollar

People often make the mistake of thinking they know where their money is going; in reality, even small expenses add up quickly.

Use budgeting apps such as Mint, YNAB or QuickBooks to track your income and expenses. Review bank statements monthly in order to identify unnecessary costs.

And for businesses, try keeping both personal and business finances separate for greater clarity.

If you require quick calculations, an online scientific calculator is a valuable asset. Professionals commonly utilize scientific calculators online for financial calculations and budget planning purposes as well as profit analysis purposes. A scientific calculator online is especially helpful for reviewing estimates before making big financial decisions.

2. Eliminate Unnecessary Expenses

Want to keep more of your money? Identify and eliminate unnecessary spending.

Owners: Are You Paying For Unused Software Subscriptions, Negotiate Lower Supplier

Costs Or Freelancers: Are You Spending Too Much On Tools You Rarely Use or

Employees: Could Daily expenses like $5 Coffees Be Depleting Your Paycheck

Little savings add up over time! Even small cuts add up, helping your savings to grow.

3. Increase Your Earnings Without Increase Stress

More revenue doesn’t always translate to greater net income–unless you know how to earn smart.

Business Owners: Instead of simply increasing sales volumes, increase prices strategically or explore alternative income sources (like digital products).

Freelancers: Provide premium services, negotiate higher rates or add retainer clients.

Employed: Research career growth opportunities, side gigs or passive income ideas to add extra money to the bank account.

Focusing on high-value income sources can increase your net income without draining you of energy and enthusiasm.

4. Plan for Taxes & Surprises

mes A common misstep people make is forgetting about taxes and emergency expenses when planning their budgets.

Pro Tip: For self-employed individuals, set aside 30% of earnings as taxes – doing this can save financial strain in the future.

Establishing an emergency fund will protect against unexpected costs from draining your net income, so be sure to set aside at least three to six months’ of expenses as an emergency savings.

Final Thoughts: Why Net Income Is Key to Financial Freedom

It all boils down to how much of your net income stays in your wallet – whether that be as an employee, freelancer, business owner or freelancer. Understanding and monitoring net income are the keys to financial success regardless of what field it’s coming from.

By following these simple steps – such as tracking your money, cutting costs, increasing earnings and planning for taxes–you can take control of your financial future and take back power over it.

Remember, financial clarity leads to financial freedom. When you gain a better understanding of your money, the more empowered and confident you become when making wise and confident financial decisions.